Overhead Absorption Rate Formula

In absorption costing Unit Costs of Product Direct Cost Production Overhead Cost. If the total production overhead is 15000 and the cost of direct materials is 60000 then.

Predetermined overhead rate is used to apply manufacturing overhead to products or job orders and is usually computed at the beginning of each period by dividing the estimated manufacturing overhead cost by an allocation base also known as activity base or activity driver.

. Forward Rate applicable for the period t-11 Relevance and Use of Forward Rate Formula. The overhead is attributed to a product or service on the basis of direct labor hours. That overhead absorption rate is the manufacturing overhead costs per unit called the cost driver which is labor costs labor hours and machine hours.

Here we discuss the calculation of the predetermined overhead rate using its formula and downloadable excel template. Finally allocate the overhead by multiplying the overhead rate by the number of labor hours required. Production Overhead Cost Variable Manufacturing Overhead Fixed Manufacturing Overhead.

The machine hour rate is similar to the labour hour rate method and is used where the work is performed primarily on machines. Price Rate Quantity Total Cost. Normally the forward rates are used by the investors who believe that they have a good understanding of market trends from immediate past to current market scenario relative to.

Finally the formula for an annualized rate of return can be derived by dividing the sum of initial investment value step 1 and the periodic gains or losses step 2 by its initial value which is then raised to the reciprocal of the holding period step 3 and then minus one as shown below. Formula Calculation Problems and Solutions. Direct Cost Direct Material Direct Labor.

Lets say you brought in 28000 last month and spent 1800 in overhead costs. Machine Hour Rate Method 6. Here according to this method the absorption rate will be 25.

Overhead absorption is required by both GAAP and IFRS for external financial reporting. For every dollar you made last month you spent 006 on overhead costs. The rate is calculated as follows.

The indirect costs are not directly traceable. Rate per Unit of Production Method 7. You can learn more about accounting from the following articles Calculate Absorption Costing.

For small widgets the allocation equals. The amount of indirect costs that are assigned to goods and services is known as overhead absorption. Direct Labour Cost or Direct Wages Method 3.

A final products cost is based on a pre-determined overhead absorption rate. Prime Cost Percentage Method 4. The reason why manufacturing overhead is referred by indirect costs is that its hard to trace them to the product.

Heres the formula for overhead rate. Commonly used allocation bases are direct labor hours direct labor dollars machine hours. Overhead Rate 006 or 6.

Overhead Rate Overhead Costs Income From Sales. Factory overheadMachine hours If factory overhead is Rs 3 00000 and. Now let see the formula of absorption costing Absorption Costing Formula.

Rate 15000 x 100 60000 25. Direct Labour Hour Method 5. Where stt-period Spot Rate st-1t-1-period Spot Rate ft-1 1.

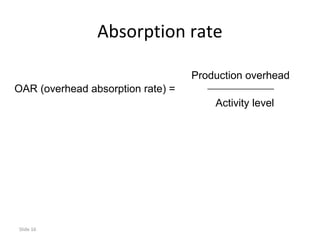

Overhead absorption rate Total estimated overheads Total direct material cost for all production x 100. How to Calculate Overhead Absorption Rate. Overhead Absorption Rate per Unit Factory Overhead Units of Production 7 Sales Price Method.

When you plug those numbers into the equation it looks like this. This article has been a guide to the Predetermined Overhead Rate Formula. Under this method the overhead budget Overhead Budget Overhead Budget is prepared to forecast and present all the expected costs concerning manufacturing the goods that the company expects to incur in the next year.

The following are the various methods and techniques of absorbing manufacturing overhead. Overhead Rate 1800 30000. Forward Rate ft-1 11stt 1st-1t-1 -1.

The formula for the same is as follows. Formula of Overhead Ratio Formula Of Overhead Ratio The overhead ratio. The formula used in computing the rate is.

Direct Material Cost Method 2.

Calculation Of Ebac Overhead Absorption Rate Home Style Download Table

Calculation Of Abc Overhead Absorption Rate Kino Publishing Co Download Table

Comments

Post a Comment